Crypto & Blockchain: Real-World Use Cases, Exchanges, and How to Avoid Scams

When you hear Crypto, digital assets built on decentralized networks that let people send value without banks. Also known as cryptocurrency, it’s not just about Bitcoin price charts—it’s about real systems replacing old financial tools. Behind every coin is a Blockchain, a public, tamper-proof ledger that records transactions across many computers. Also known as distributed ledger technology, it’s the engine that makes crypto, smart contracts, and decentralized apps possible. This isn’t theory. People in Cuba use Bitcoin to buy groceries because banks won’t serve them. Traders on PancakeSwap v4 slash gas fees by 99% to flip meme coins. And platforms like Chainalysis help governments track stolen crypto—not because they hate crypto, but because criminals use it too.

Crypto exchange, a platform where you buy, sell, or trade digital assets. Also known as DEX or CEX, it’s where most people actually interact with crypto. Some, like SpireX and Huckleberry, are regulated and clean. Others, like Slex or Joyso, hide their team, lack volume, and offer no real security. Then there are airdrops—free tokens promised to get you to sign up. Most are scams. DeHero HEROES, IMM, and ZWZ? All dead ends. Real airdrops don’t ask for your private key. They don’t rush you. And they’re tied to working products, not hype.

You’ll find guides here on how DeFi liquidity pools eat your money if you’re not careful, why governance attacks can drain millions from a project’s treasury, and how BaaS lets Uber and Shopify offer banking without being a bank. You’ll see what’s real in Hong Kong’s new 2025 rules, why Egypt’s ban is stricter than it looks, and how meme coins like OMIKAMI survive without any utility—just branding and community. This isn’t a list of price predictions. It’s a map of what’s actually happening: the good, the broken, and the outright fake. Whether you’re holding one coin or managing a portfolio, you need to know who’s building something useful and who’s just collecting wallet addresses. Below, you’ll find real breakdowns—not fluff. No guesswork. Just facts.

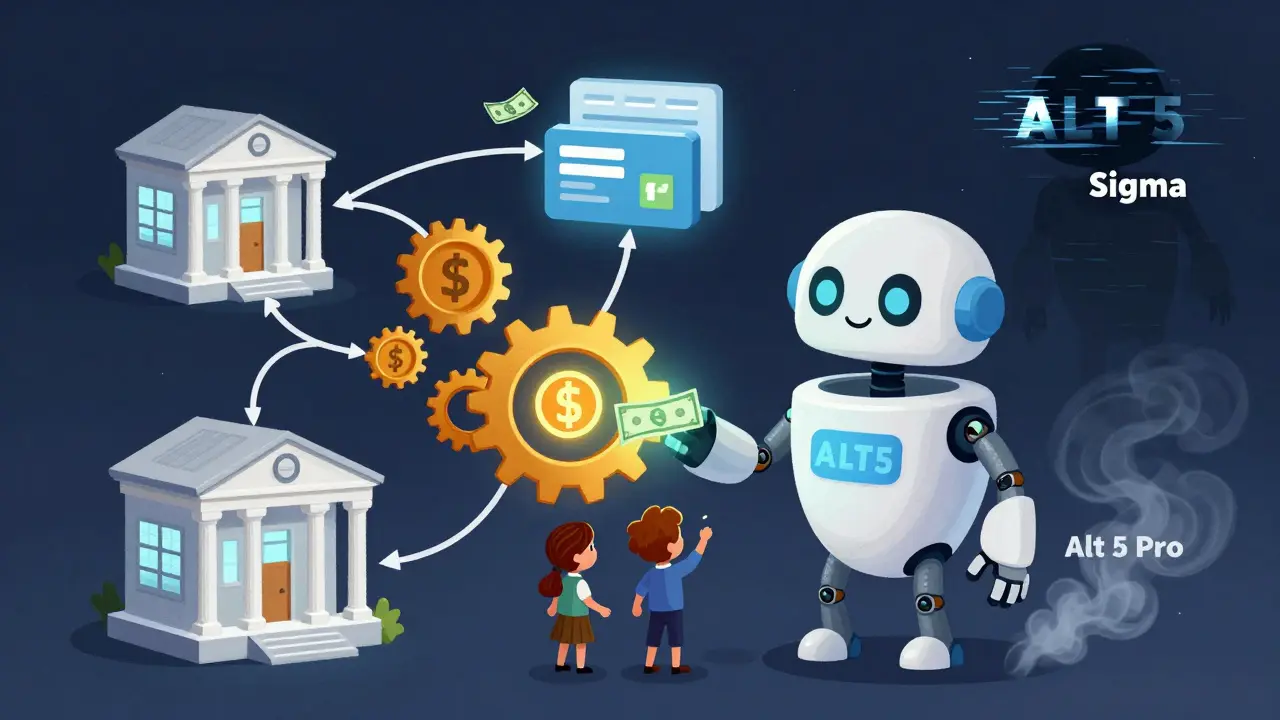

Alt 5 Pro crypto exchange review: What you need to know about ALT5 Sigma

There is no 'Alt 5 Pro' crypto exchange. This review clarifies that ALT5 Sigma is a B2B infrastructure provider, not a retail trading platform. Learn what it actually does, who uses it, and why it's not a scam.

Genshiro (GENS) Airdrop Details: How It Worked and What Happened Since

The Genshiro (GENS) airdrop in 2022 distributed over 2 million tokens through MEXC and Gate.io, but the token price crashed over 99% since then. Learn how it worked, why it failed, and if it still has a future.

What is RENEC (RENEC) Crypto Coin? A Clear Breakdown of the Token, Its Use, and Market Reality

RENEC is a blockchain token built to simplify Web3 for everyday users, but with a $2.6M market cap and $0 trading volume, its real-world use remains unproven. Learn what it does, who uses it, and why most experts ignore it.

Kalata Protocol Crypto Review: What It Really Is (And Why It's Not an Exchange)

Kalata Protocol (KALA) is not a crypto exchange - it's a high-risk DeFi protocol on Binance Smart Chain with no audits, anonymous developers, and dangerously low liquidity. Here's what you need to know before touching it.

FSC Crypto Regulations in Taiwan for Exchanges: What You Need to Know in 2026

Taiwan's FSC enforces strict crypto exchange regulations requiring AML registration, asset segregation, and cybersecurity. Only registered platforms can operate legally, with severe penalties for violations. Security tokens and ETFs are tightly controlled, making Taiwan a model for balanced crypto oversight.

Saudi Crypto Regulation Development and Future: What’s Allowed, What’s Coming in 2026

Saudi Arabia's crypto rules are shifting from outright bans to controlled adoption. Learn what's legal today, what's coming in 2026, and how individuals and businesses should prepare.

What is Parcl (PRCL) Crypto Coin? A Simple Guide to Real Estate Trading on Blockchain

Parcl (PRCL) is a Solana-based DeFi platform that lets you trade real estate markets like stocks - no property needed. Learn how PRCL works, its real use cases, risks, and why it’s changing how people access housing markets.

How to Read Spot Price Charts for Crypto and Stocks

Learn how to read spot price charts using candlesticks, volume, and key patterns to make smarter trading decisions in crypto and stocks. No fluff - just what works.

VikingsChain (VIKC) Airdrop: What's Real and What's Not in 2026

VikingsChain (VIKC) has no active airdrop in 2026. The token trades at $0, the game never launched, and any claims of free VIKC are scams. Learn what really happened-and where to find real crypto rewards instead.

What is KingdomStarter (KDG) crypto coin?

KingdomStarter (KDG) is a blockchain platform combining a launchpad, NFT marketplace, and gaming ecosystem. Despite its multi-use design, KDG trades at near-all-time lows with minimal liquidity and no clear user growth.

How Governance Tokens Enable DAO Voting

Governance tokens let DAO members vote on key decisions like protocol changes and treasury use. They power over 10,000 decentralized organizations, but issues like whale dominance and low voter turnout reveal deep flaws in how they work today.

Whale Accumulation vs Distribution in Crypto: How Big Holders Move Markets

Whale accumulation and distribution are critical phases in crypto markets where large holders quietly buy or sell, shaping price trends before they become obvious. Learn how to spot these signals and use them wisely.