Finance in Crypto: Risks, Regulations, and Real-World Trading

When you think of crypto finance, the intersection of digital assets with banking, taxes, and government oversight. Also known as digital asset finance, it’s not just about buying and selling—it’s about navigating rules that can freeze your bank account, slap you with a 30% tax bill, or land you in legal trouble. This isn’t the wild west anymore. Governments and banks have built systems to track every crypto move, and ignoring them doesn’t make you smart—it makes you risky.

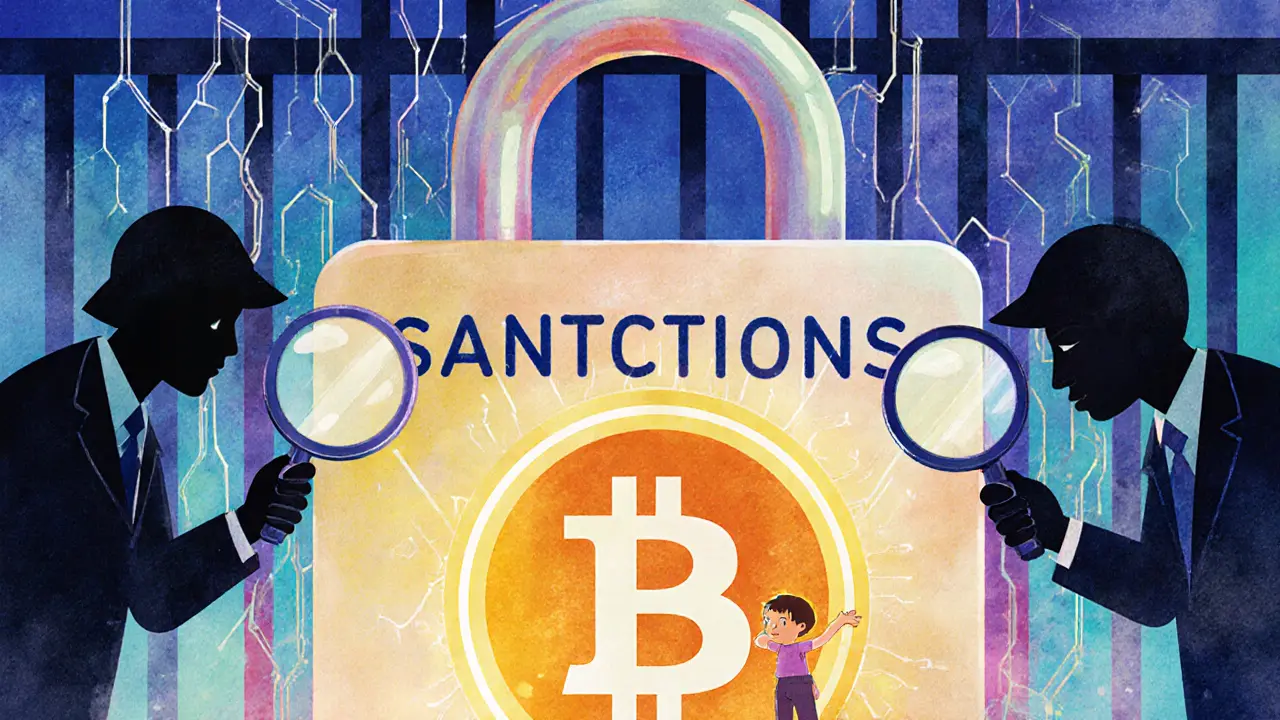

One major part of crypto finance is crypto regulations, the legal frameworks countries use to control how digital assets are bought, sold, and taxed. In the Netherlands, exchanges like SATOS must be licensed by De Nederlandsche Bank. In India, you pay 30% on profits, 1% on every trade, and GST on platform fees. These aren’t suggestions—they’re enforced by audits, bank reports, and criminal penalties. Trying to bypass these rules? That’s not a hack. It’s a federal offense, as shown by cases where people got hit with fines or jail time for hiding crypto transactions from OFAC or MiCA regulators. Then there’s crypto exchanges, the platforms where you actually trade coins, and they’re split into two worlds: compliant ones that ask for your ID, and no-KYC ones that don’t. ZoomEx offers 150x leverage and no identity checks, which sounds great until your funds get seized or the site vanishes. Meanwhile, SATOS won’t let you deposit with a credit card, but your money stays safe under Dutch law. Your choice isn’t about speed—it’s about risk tolerance. And don’t forget crypto taxes, the unavoidable cost of turning digital gains into real cash. In 2025, tax agencies use blockchain analytics to trace every wallet transfer. If you didn’t report your Dogecoin profit from last year, they already know—and they’re sending letters. Even if you think you’re invisible, your bank knows. If you’ve ever had an account frozen for crypto activity, it’s not a mistake. It’s compliance.

Whether you’re holding a location-based token like DGMA, trading on a no-KYC platform, or just trying to avoid a tax audit, crypto finance today demands more than curiosity—it demands awareness. You don’t need to be a lawyer or an accountant, but you do need to know what’s legal, what’s tracked, and what’s a trap. Below, you’ll find real breakdowns of the exchanges, penalties, and loopholes that actually matter right now. No theory. No fluff. Just what’s happening, who it affects, and how to protect yourself.

Crypto Tax Enforcement and Penalties in India: What You Need to Know in 2025

India imposes a 30% tax on crypto gains, 1% TDS on trades, and 18% GST on platform services. Learn how enforcement works, what penalties you face if you don’t report, and how to file correctly in 2025.

SATOS Crypto Exchange Review: Is It the Best Choice for Dutch Crypto Users in 2025?

SATOS is a regulated Dutch crypto exchange supervised by De Nederlandsche Bank. With 1% trading fees, bank-only deposits, and Dutch-only support, it's ideal for risk-averse users seeking legal protection over low costs. Best for Dutch residents wanting safe, compliant crypto access.

Why Your Bank Account Got Frozen for Crypto Activity in 2025

In 2025, your bank can freeze your account for crypto activity-even if you did nothing wrong. Here’s why it’s happening, how it works, and what you can do to protect yourself.

ZoomEx Crypto Exchange Review: No-KYC Trading, High Liquidity, and 150x Leverage

ZoomEx is a no-KYC crypto exchange offering high liquidity, 150x leverage, and low fees. Perfect for privacy-focused traders who want fast access without ID verification. Supports 500+ trading pairs and copy trading for beginners.

What is DaGama World (DGMA) Crypto Coin? A Real-World Location Token Explained

DaGama World (DGMA) is a blockchain-based crypto token that rewards users for verifying real-world locations. It aims to fight fake reviews using AI and NFTs, but faces challenges in adoption and transparency.

Risks of Circumventing Crypto Restrictions: Legal Analysis

Circumventing crypto sanctions is not a loophole-it’s a federal crime. Learn why blockchain tracking, legal penalties, and exchange compliance make crypto-based evasion nearly impossible and incredibly risky.