Don’t be fooled by the name. Cramer Coin (CRAMER) isn’t backed by Jim Cramer. It doesn’t have a team. It doesn’t have a whitepaper. And it certainly isn’t the next Bitcoin. As of January 2026, this token trades at around $0.000083, with a market cap under $70,000 and a 24-hour trading volume of just $4.22. That’s less than the cost of a coffee. If you’re wondering whether this is a real cryptocurrency worth your time, the answer is simple: no.

It’s Not Connected to Jim Cramer - And He Hates Crypto

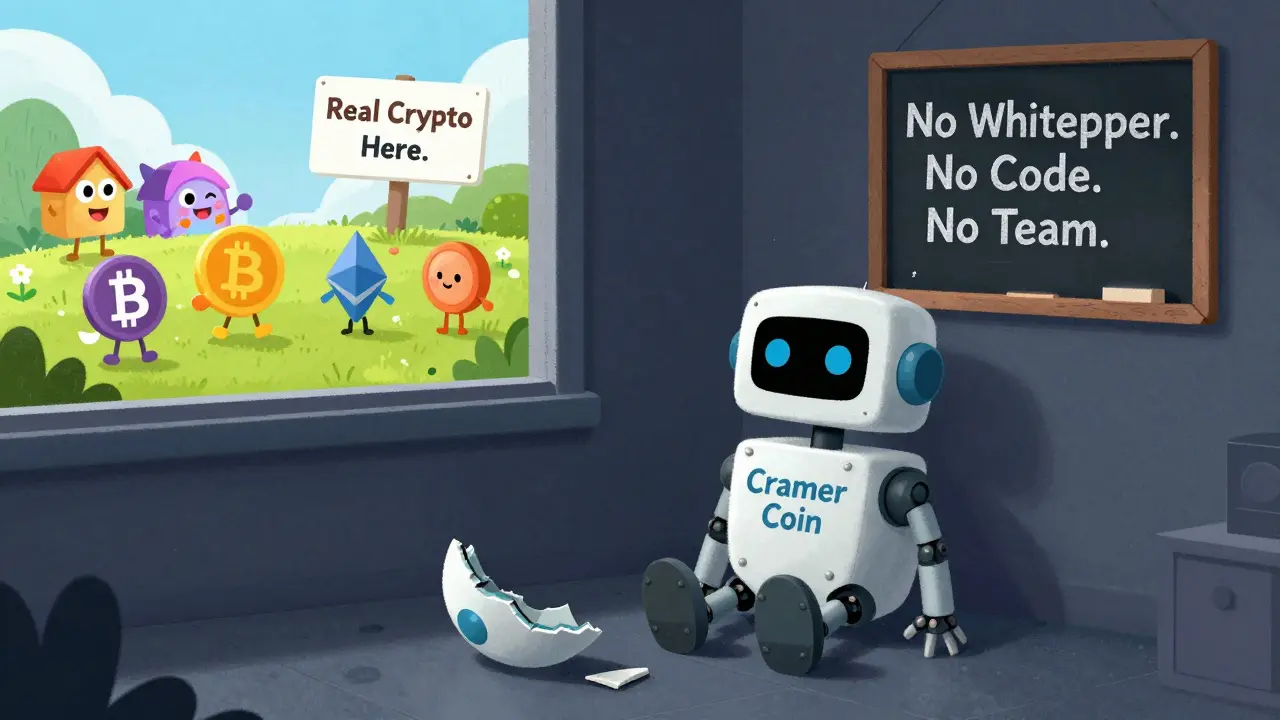

The name is the whole gimmick. Cramer Coin tries to ride on the fame of Jim Cramer, the CNBC host known for yelling "Buy! Buy! Buy!" on Mad Money. But here’s the catch: Jim Cramer has repeatedly called cryptocurrencies a scam. In a November 2025 YouTube analysis, he described crypto markets as being in "extreme fear" with sentiment in the "dumps." On CNBC in January 2026, he said outright: "I don’t trust any crypto named after me or other financial personalities - that’s just looking for a scam." Cramer Coin has zero official connection to him. No endorsement. No partnership. No permission. It’s a name stolen to trick people into thinking there’s legitimacy behind it. That’s not branding - it’s deception.No Whitepaper. No Code. No Development

Look up any legitimate crypto project - Bitcoin, Ethereum, even obscure ones like Filecoin - and you’ll find a whitepaper, a GitHub repo, active developers, and public roadmaps. Cramer Coin has none of that. No one has found a single line of code linked to this token. No GitHub repository. No technical documentation. No team addresses. No audit reports. It operates like a standard ERC-20 or BEP-20 token, meaning it runs on Ethereum or Binance Chain, but that’s it. No innovation. No utility. No purpose. It doesn’t solve a problem. It doesn’t power a dApp. It doesn’t reward holders. It’s just a number on a screen, floating in a sea of zero trading activity.Trading Volume? Almost Zero

Market cap means nothing if no one is buying or selling. Cramer Coin’s $70,000 market cap is built on paper, not real demand. On Bybit, the 24-hour volume was $4.22. On CoinMarketCap, it showed $0. That’s not a glitch - that’s normal for this token. What does that mean for you? If you buy CRAMER, you might not be able to sell it. Orders often go unfilled. One user on CryptoSlate reported losing $50 trying to sell 600 million CRAMER tokens - the order never went through after three days. On Binance, the spread (difference between buy and sell price) is often over 15%. That means if you buy at $0.000083, you’d need the price to jump to $0.000095 just to break even after fees. And that’s if anyone even wants to buy.

It’s Listed on Big Exchanges - So It Must Be Safe, Right?

Wrong. Binance, MEXC, Bybit, and LBank all list CRAMER. But listing doesn’t mean approval. These exchanges make money from trading fees, not from vetting quality. LBank even openly tells users to "profit from buying low and selling high" because of "constant price fluctuations" - a red flag if there ever was one. Binance’s own rules say a token needs at least $5,000 in daily volume to stay listed. CRAMER hasn’t hit that in months. Yet it’s still there. Why? Because exchanges don’t remove tokens unless regulators force them to. And even then, they often wait until the token is completely dead.Community? There Isn’t One

Real crypto projects have communities. Reddit threads with thousands of members. Discord servers with active developers answering questions. Telegram groups with real updates. CRAMER has none of that. The subreddit r/CramerCoin has 12 members. The last post was six months ago. The Telegram group "CRAMER Coin Alerts" has 87 members - but the last message was January 5, 2026. And guess what? Most of those messages were pump signals from anonymous accounts with no track record. Compare that to Filecoin, which has over 50,000 Reddit members and 1,200+ GitHub contributors. CRAMER doesn’t even come close. No community means no support. No feedback. No future.It’s a Classic Pump-and-Dump

This is textbook pump-and-dump. A token with no utility, no team, no volume, and a name that tricks people into thinking it’s connected to a famous person. Chainalysis found that 87% of celebrity-named tokens are pump-and-dump schemes. Dr. David Gerard, author of Attack of the 50 Foot Blockchain, says these coins are "99.9% guaranteed to be scams." Peter Schiff, a well-known crypto skeptic, called them "deliberately misleading investors." And now the SEC agrees. In January 2026, they took legal action against "CelebrityCoin" - a token using a famous person’s name without permission - for violating securities laws. CRAMER is in the same category.

What Happens If You Buy It?

Let’s say you buy $100 worth of CRAMER. You’re buying 1.2 billion tokens. But here’s the problem: Binance requires a minimum order size of 10 million CRAMER to avoid "dust" - that’s $0.83. So you’re forced to buy in chunks you can’t easily sell. If the price goes up 10%? Great. But who’s going to buy it from you? There are maybe three buyers a day. You’ll be stuck holding it for weeks. If the price drops? You’ll lose money fast. There’s no safety net. No team to fix things. No roadmap to follow. Just silence.Why Does This Even Exist?

Because someone made money off it. Someone created this token, dumped it on exchanges, and used social media to push it to gullible investors. They likely sold their entire supply early, cashed out, and disappeared. The token is now a ghost - trading on autopilot, with no one left to care except new people hoping to get lucky. This is the dark side of crypto. Not the blockchain revolution. Not decentralized finance. Just a casino with fake names and zero rules.Final Verdict: Avoid Cramer Coin

Cramer Coin isn’t an investment. It’s a trap. It has no utility, no community, no development, and no future. It exists only to lure people into a liquidity void where prices are manipulated by bots and insiders. If you’re looking for crypto opportunities, look at projects with real code, real teams, and real trading volume. Don’t chase names. Don’t fall for gimmicks. And definitely don’t let a CNBC host’s name fool you into risking your money on a token he’d call a scam.Is Cramer Coin (CRAMER) a real cryptocurrency?

No, Cramer Coin is not a real cryptocurrency in any meaningful sense. It has no whitepaper, no development team, no GitHub activity, and no utility. It’s a low-cap token with near-zero trading volume, created solely to exploit the name recognition of Jim Cramer. It lacks the technical foundation and community support that define legitimate crypto projects.

Is Cramer Coin connected to Jim Cramer?

No, Jim Cramer has no connection to Cramer Coin. He has publicly criticized cryptocurrencies multiple times, calling them scams and warning against tokens named after financial figures. In January 2026, he explicitly said, "I don’t trust any crypto named after me or other financial personalities." The token uses his name without permission to mislead investors.

Can I make money trading Cramer Coin?

Technically, yes - but only if you’re lucky or already own it. With a 24-hour trading volume of under $5, selling even a small amount can take days because there are almost no buyers. The spreads are wide, liquidity is nonexistent, and the risk of getting stuck with worthless tokens is extremely high. Most people who trade CRAMER lose money, not because the price drops - but because they can’t exit their position.

Why is Cramer Coin listed on Binance and other big exchanges?

Exchanges list low-quality tokens because they make money from trading fees, not because they approve them. Binance, MEXC, and Bybit don’t require tokens to have real utility or volume to stay listed - only that they meet basic technical requirements. CRAMER has been listed because it’s technically a BEP-20 or ERC-20 token, not because it’s a good investment. Exchanges often remove these tokens only after regulators step in.

Is Cramer Coin a scam?

Yes, by all industry standards, Cramer Coin is a scam. It fits the profile of a pump-and-dump scheme: no utility, no team, no community, and a name designed to trick people. Chainalysis and Dr. David Gerard have both labeled celebrity-named tokens like this as 99.9% likely to be scams. The SEC has already taken legal action against similar tokens for fraud. CRAMER is not a cryptocurrency - it’s a financial trap.

Should I invest in Cramer Coin?

Absolutely not. Investing in Cramer Coin is like buying a lottery ticket with no chance of winning. There’s no path to value, no development, and no liquidity. Even if the price rises briefly, you won’t be able to sell. Your money will vanish into a void with no recourse. Stick to projects with transparent teams, real code, and consistent trading volume - not names on a ticker.

Josh V

January 17 2026this is why you dont trust anything with a celebrity name

theyre just trying to cash in on your dumb ass

cramer hates crypto and this is still out there