Cuba Cryptocurrency: What’s Really Happening with Crypto in Cuba

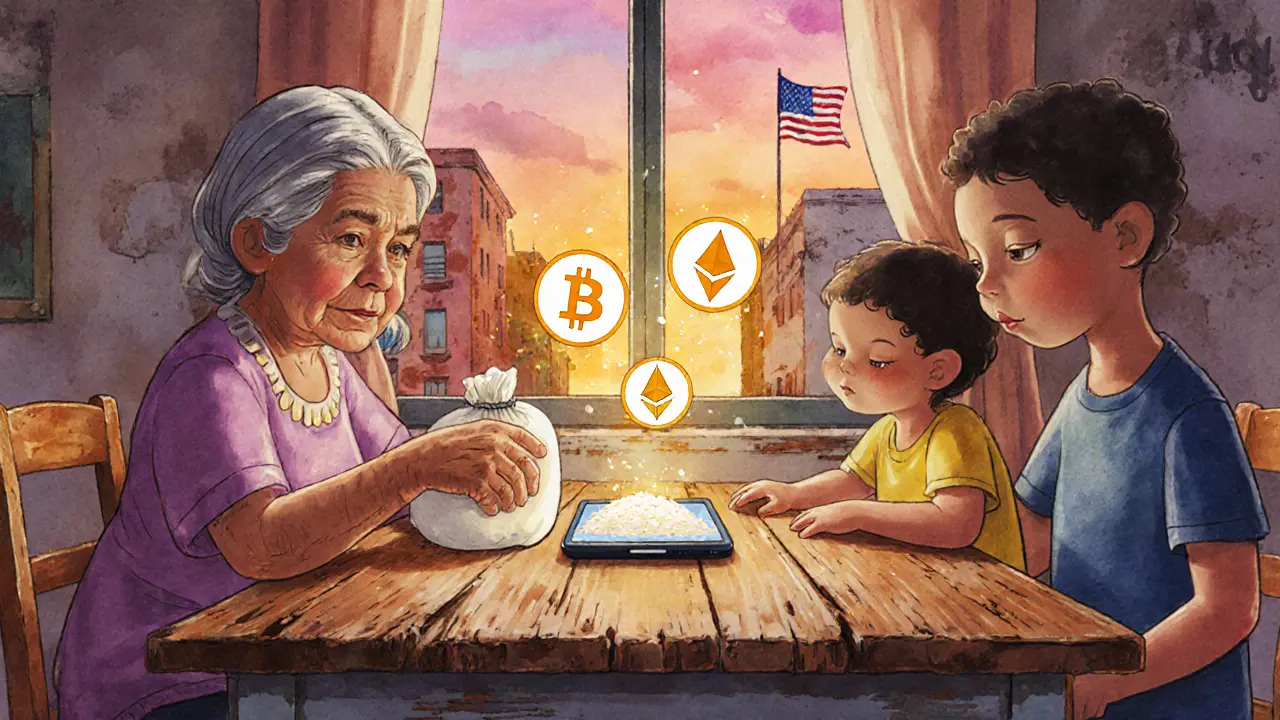

When people talk about Cuba cryptocurrency, the use of digital currencies like Bitcoin and Ethereum by individuals in Cuba despite government restrictions. Also known as crypto in Cuba, it’s not about official policy—it’s about survival. The Cuban government doesn’t recognize cryptocurrency as legal tender. No banks support it. No exchanges are licensed. Yet, millions of Cubans use crypto every day to send money home, buy food, and trade for essentials.

This isn’t a tech trend. It’s a workaround. With hyperinflation, state-controlled salaries, and blocked international payments, crypto became the only reliable way to move value. People use peer-to-peer platforms like Paxful and LocalBitcoins to trade USD for Bitcoin, then convert it to pesos through local traders. Some even use crypto to pay for medicine imported from abroad. The blockchain Cuba, the decentralized network enabling financial access without state intermediaries is the real hero here—not the government, not the banks, but the tech itself.

And it’s not just Bitcoin. Ethereum, USDT, and even smaller tokens are circulating in informal networks. Telegram groups and WhatsApp chats are full of traders swapping crypto for cash in parks or cafés. The Cuban crypto regulations, the unofficial rules enforced by the state to control digital finance are vague but strict: no official exchanges, no mining licenses, no crypto advertising. But enforcement? That’s another story. Surveillance is limited, and the need for cash outweighs the risk.

What you won’t hear in state media is how crypto is changing daily life. A teacher in Santiago might get paid in crypto from a relative in Miami. A mechanic in Havana uses USDT to buy parts from a supplier in Colombia. A student in Pinar del Río trades Bitcoin for groceries via a local vendor. This isn’t speculation. It’s subsistence. And it’s growing.

There’s no official roadmap for crypto in Cuba. No white papers from the central bank. No public consultations. Just people using tools they can access—tools that don’t need permission. The cryptocurrency adoption Cuba, the grassroots, unplanned, and relentless use of digital assets to bypass economic isolation is happening because there’s no other option.

Below, you’ll find real stories, broken regulations, and deep dives into how crypto actually works on the ground in Cuba—not what the government says, but what people are doing to survive. No fluff. No politics. Just facts from the front lines.

Cuba Cryptocurrency Regulation: Legal Use, Not Prohibition

Cuba doesn't ban cryptocurrency - it regulates it. With U.S. sanctions cutting off banking access, Cubans turned to Bitcoin and other digital currencies to survive. Now, the government licenses crypto services, making it one of the few countries to legally embrace crypto out of necessity.