Crypto Regulation in Cuba: What You Need to Know About Bitcoin, Bans, and Blockchain Use

When it comes to crypto regulation in Cuba, the government’s stance on digital currencies is restrictive, opaque, and evolving under political and economic pressure. Also known as Cuban cryptocurrency policy, it’s not a full ban like Egypt’s Law 194—but it’s not freedom either. The Cuban state doesn’t recognize Bitcoin or any crypto as legal tender. You can’t pay for groceries with Ethereum. You can’t open a crypto account at a state bank. And if you’re caught running a node or trading on a foreign exchange, you might get a warning, a fine, or worse.

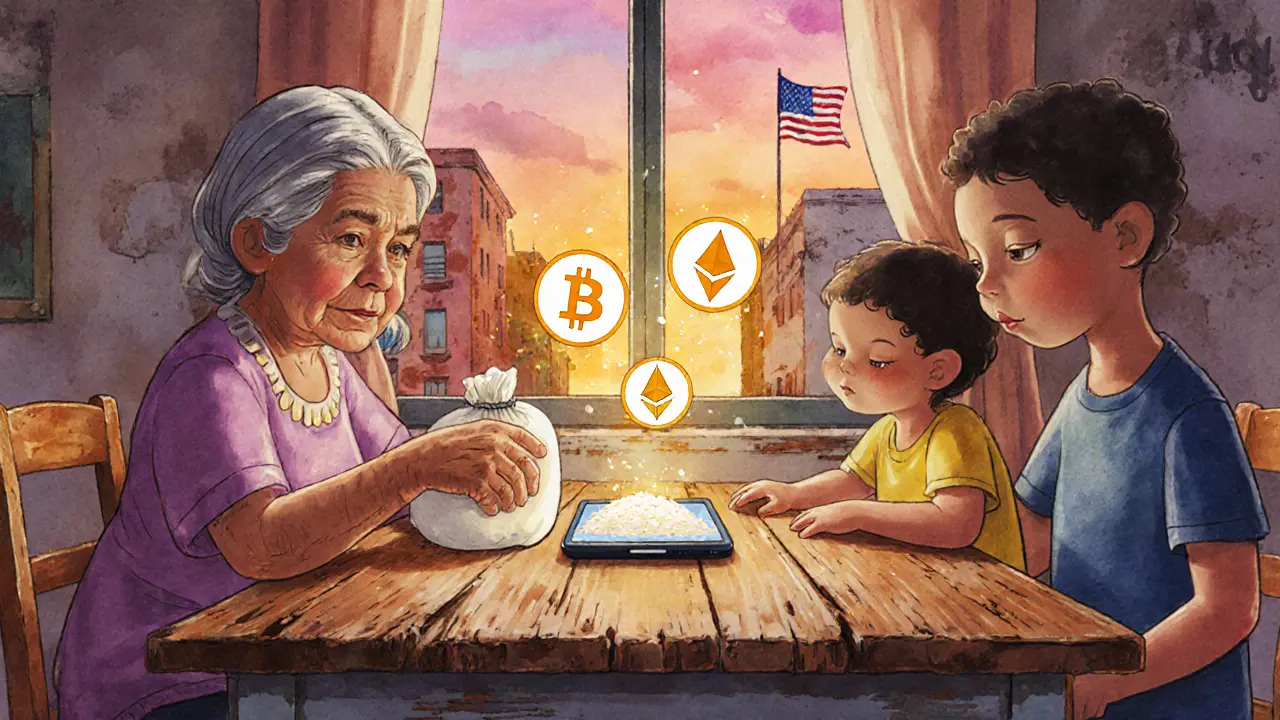

But here’s the twist: millions of Cubans still use crypto anyway. Why? Because the peso is collapsing, remittances from abroad are lifelines, and platforms like Paxful and Binance P2P let people trade USD for crypto without waiting weeks for a bank transfer. The government knows this. They’ve cracked down on crypto-related ads and blocked access to some exchanges. Yet, they haven’t shut down the entire system. Why? Because they can’t. Crypto is too useful for ordinary people trying to survive.

Meanwhile, blockchain Cuba, a concept that sounds futuristic but is quietly growing in underground networks. Also known as Cuban decentralized tech, it’s not about NFTs or DeFi—it’s about survival. Some doctors use crypto to get medicine from abroad. Some artists sell digital art for Bitcoin to avoid state-controlled payment systems. And yes, there are reports of small startups using smart contracts to handle cross-border payments with minimal interference. It’s not official. It’s not safe. But it’s real. The Bitcoin Cuba, the most common form of crypto used by locals. Also known as BTC in Cuba, it’s not held as an investment—it’s held as a store of value, like gold, but digital and transferable. The government doesn’t want you to own it, but they can’t stop you from buying it with cash on the street.

Compare this to places like Hong Kong or Saudi Arabia, where crypto rules are clear—even if strict. In Cuba, there’s no lawbook. No licensing system. No official guidance. Just silence, suspicion, and a lot of people using apps they downloaded from Telegram. That’s why you’ll find posts here about crypto regulation Cuba that expose scams, warn about wallet drains, and reveal how people are quietly building financial alternatives outside the state’s reach.

What you’ll find below isn’t a list of legal advice or government reports. It’s real stories from the frontlines: how Cubans bypass restrictions, what tools they use, and why some crypto projects that work elsewhere fail completely in this environment. You’ll see how blockchain forensics tools like Chainalysis have no role here—not because they’re weak, but because there’s no system to trace. You’ll see how airdrops that work in the U.S. are dangerous traps in Havana. And you’ll learn why the only thing more powerful than regulation in Cuba is necessity.

Cuba Cryptocurrency Regulation: Legal Use, Not Prohibition

Cuba doesn't ban cryptocurrency - it regulates it. With U.S. sanctions cutting off banking access, Cubans turned to Bitcoin and other digital currencies to survive. Now, the government licenses crypto services, making it one of the few countries to legally embrace crypto out of necessity.