When you're new to cryptocurrency and living in South Africa or Nigeria, finding a local exchange that lets you deposit via credit card or bank transfer feels like a breakthrough. That’s what iCE3 promised - a simple way to buy Bitcoin and Litecoin without jumping through international hoops. But today, iCE3 doesn’t just lack service. It’s gone silent. No deposits. No withdrawals. No answers. And if you had funds there, you’re still waiting.

What iCE3 Actually Offered (Before It Shut Down)

iCE3 launched with a clear goal: make crypto accessible to everyday people in Africa. Unlike big global exchanges that require complex bank wires or third-party on-ramps, iCE3 let users deposit directly via South African and Nigerian bank transfers and even credit cards. That’s huge. For someone without a US bank account or access to Paxful or Binance P2P, this was one of the few ways to get started.

The platform supported Bitcoin (BTC) and Litecoin (LTC) trading. It had two-factor authentication (2FA), which sounds good - until you realize most exchanges now use app-based 2FA like Authy or Google Authenticator, not SMS. iCE3’s 2FA was basic. And while they claimed to have manual checks for suspicious transactions, that’s not enough. Manual reviews are slow, error-prone, and easily bypassed by organized fraud.

They also said they updated security “every few months.” But updates don’t mean security. If your house has a lock, but the key is left under the mat, changing the paint color won’t help.

The Crash: How iCE3 Lost Control of User Funds

In late 2024 or early 2025, iCE3 made an announcement that should have sent every user running for the exits: they discovered “discrepancies in the balances pertaining to Bitcoin and Litecoin we hold on the platform.”

They didn’t say how much was missing. They didn’t say who was responsible. They didn’t even say if it was a hack, a mistake, or theft. All they said was that they were working with two partners - Merkeleon.com and Coinspaid.com - and couldn’t reconcile the numbers.

So what happened? Based on industry standards, here’s what likely went wrong:

- iCE3 didn’t store most of its users’ funds in cold storage. Instead, they relied on Merkeleon and Coinspaid to hold the assets.

- That’s like trusting your neighbor to keep your car keys while you’re away - and then finding out they gave them to someone else.

- There was no independent audit of the partner wallets. No real-time tracking. No multi-signature controls.

- When the numbers didn’t add up, iCE3 didn’t have the records to prove who owned what.

This isn’t a hack. This is negligence. And it’s exactly how smaller exchanges die.

Why This Was a Security Disaster Waiting to Happen

Top exchanges - Binance, Kraken, Coinbase - keep 95% or more of user funds in cold storage. That means offline, air-gapped, encrypted wallets with multiple keys required to move money. They also use multi-signature setups. Even if one person gets hacked, they can’t move funds alone.

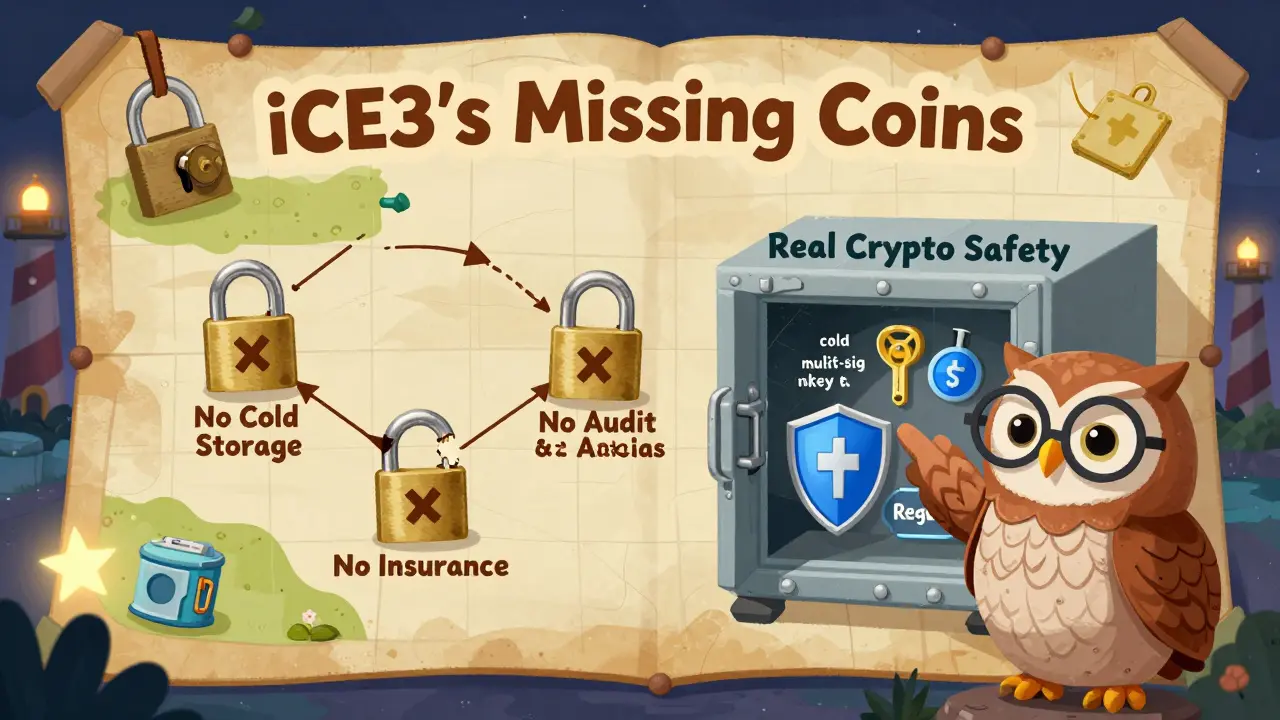

iCE3? No mention of cold storage. No mention of multi-sig. No public proof of reserves. Just a vague promise that they were “secure.”

They also didn’t have:

- Real-time transaction monitoring

- DDoS protection

- AI-based fraud detection

- IP blocking to prevent sanctions violations

- Any public record of regulatory compliance

Chainalysis and Chainup both say exchanges that skip these basics don’t last. And iCE3 didn’t.

What Happened After the Suspension?

After the announcement, iCE3 shut down all BTC and LTC withdrawals. Deposits stopped. Trading stopped. No one could access their money.

And then - silence.

No updates. No timeline. No transparency. No communication channel for users. That’s the worst part. Legitimate exchanges, even during crises, send weekly emails. They post status updates. They answer questions. iCE3 didn’t.

There are no user reviews on Trustpilot. No Reddit threads. No Twitter updates. That’s not because people stopped using it - it’s because they can’t.

Compare this to Mt. Gox. That exchange collapsed in 2014. Users waited nearly a decade for any recovery. And even then, most never got their money back.

iCE3’s situation is similar - but with one key difference: it never had the scale, infrastructure, or transparency to even deserve trust.

Who Was Behind iCE3? And Why It Matters

Their partners - Merkeleon.com and Coinspaid.com - are payment processors, not crypto custody firms. Coinspaid, for example, lets businesses accept crypto payments. They don’t run exchanges. They don’t hold user assets long-term. That’s a red flag.

Using a payment processor to store your users’ Bitcoin? That’s like using a grocery store checkout to store your savings. It’s not designed for that. It’s not secure for that. And when things go wrong, you’re at their mercy.

There’s no evidence iCE3 was licensed by any financial authority - not South Africa’s FSCA, not Nigeria’s SEC, not even FATF. No regulatory oversight means no accountability.

And here’s the brutal truth: if you lost money on iCE3, you have no legal recourse. No insurance. No recovery fund. No government backstop. Just a website with a message saying “we’re investigating.”

Is There Any Hope for Recovery?

Almost certainly not.

Exchanges that suspend services due to internal balance discrepancies almost never recover. Why? Because if they can’t track their own funds, how can they prove they can return yours? There’s no public ledger. No blockchain audit. No third-party verification.

Even if they somehow find the missing coins, they’d need to prove it. And they haven’t even tried.

Users are left with two choices: wait forever, or accept the loss.

What You Should Do If You Used iCE3

If you still have funds on iCE3:

- Stop checking the website daily. It won’t change.

- Document everything: transaction IDs, dates, screenshots.

- Reach out to local crypto advocacy groups in South Africa or Nigeria. Some are organizing collective inquiries.

- Don’t fall for any “recovery service” that asks for fees. That’s a second scam.

- Move on. Find a better exchange.

Where to Go Instead (Safe Alternatives in Africa)

You still want to buy Bitcoin in South Africa or Nigeria? Here are safer options:

- Binance P2P - Lets you trade directly with local sellers. No central custody. You hold your own keys.

- Luno - Licensed in South Africa. Cold storage. Transparent reserves. 24/7 support.

- Yellow Card - Nigerian-focused. Bank deposits. Regulatory compliance. Clear audit trail.

- Kraken - Global, regulated, 98% cold storage. Supports bank transfers via SEPA and SWIFT.

These platforms don’t promise convenience over security. They prove they’re safe - and they’ve been around long enough to earn trust.

Final Thought: Don’t Fall for “Local” as a Safety Signal

Just because an exchange says it’s built for your country doesn’t mean it’s safe. iCE3 made it easy to deposit - but failed at the most basic job: keeping your money secure.

True safety isn’t about local payment options. It’s about cold storage. It’s about audits. It’s about transparency. It’s about accountability.

iCE3 had none of that. And now, it’s gone.

Is iCE3 still operating?

No. iCE3 suspended all Bitcoin and Litecoin withdrawals and trading activities in early 2025 after discovering discrepancies in its asset balances. No deposits, withdrawals, or trades have been possible since. The exchange has not provided updates or a timeline for recovery.

Can I get my money back from iCE3?

There is no confirmed path to recover funds. iCE3 did not have insurance, regulatory oversight, or public proof of reserves. The exchange blamed its partners (Merkeleon.com and Coinspaid.com) for the discrepancies, but offered no audit or verification. Users are advised to assume funds are lost unless official, verifiable updates are released - which have not occurred.

Why did iCE3 fail when other African exchanges didn’t?

iCE3 failed because it outsourced custody of user funds to third-party payment processors instead of using secure cold storage. Unlike Luno or Yellow Card, it lacked multi-signature wallets, regular audits, and regulatory compliance. Its reliance on unverified partners created a single point of failure - and when those partners couldn’t reconcile balances, iCE3 had no backup system to protect users.

Was iCE3 hacked?

There’s no evidence of a direct hack. Instead, iCE3 reported “discrepancies in balances” tied to its partners. This suggests internal mismanagement - possibly poor reconciliation, lack of custody controls, or even fraud by the third-party provider. It’s a failure of operational security, not a cyberattack.

Should I use iCE3 if it comes back online?

No. Even if iCE3 resumes operations, the trust is gone. The exchange demonstrated that it couldn’t track its own funds, lacked transparency, and failed to protect users. Rebuilding trust takes years - and iCE3 has shown no signs of doing so. Better alternatives exist with proven security and regulatory backing.