Stablecoins aren’t just another crypto trend-they’re becoming the quiet backbone of a new global financial system. While Bitcoin gets the headlines for price swings and Ethereum for smart contracts, stablecoins are quietly moving trillions in value across borders, in seconds, for pennies. And by 2028, they could be handling 2 trillion in circulation, up from $250 billion today. That’s not speculation-it’s what top financial analysts at Berkeley and McKinsey are projecting. This isn’t about replacing cash. It’s about replacing the old, slow, expensive plumbing of global finance.

Why Stablecoins Work When Traditional Systems Don’t

Think about sending money to a family member in Nigeria or paying a supplier in Vietnam. With traditional banking, you’re stuck waiting 3-5 days, paying hidden fees, and dealing with currency conversion rates that eat up 5-10% of your transfer. Now imagine doing the same thing in under 10 seconds, for less than a penny. That’s what stablecoins do. Stablecoins like USDC and USDT are digital tokens pegged 1:1 to the U.S. dollar. They run on blockchains like Ethereum, Solana, and Tron. Unlike Bitcoin, which jumps 20% in a day, stablecoins hold their value. That makes them useful-not just for traders, but for real people paying bills, running businesses, or saving money in countries where the local currency is collapsing. In Argentina, Venezuela, and Lebanon, people aren’t using stablecoins because they’re crypto fans. They’re using them because their banks froze accounts, inflation hit 200%, and the peso became worthless. Stablecoins became their lifeline. A farmer in Kenya can now get paid in USDC from a buyer in Germany, cash out to local currency via a mobile app, and never touch a bank.The Real Winners: Corporations, Not Just Crypto Traders

Most people think stablecoins are for speculators. That’s outdated. The biggest adopters right now aren’t individuals-they’re companies. Uber is testing stablecoin payments for drivers in 12 countries. Why? Because currency conversion fees on every ride add up to millions annually. Stripe lets merchants accept USDC and instantly convert it to USD, avoiding exchange rate risk. Visa now processes stablecoin settlements through its network, turning crypto into fiat at the point of sale. Even big banks like State Street are building infrastructure to custody stablecoins for institutional clients. These aren’t experiments. They’re operational shifts. Companies are choosing stablecoins because they cut costs, speed up cash flow, and remove intermediaries. A startup in India can pay its developers in the Philippines in real time, without waiting for SWIFT to clear. Treasury teams at Fortune 500 firms are moving billions in stablecoins to earn yield, instead of letting cash sit in low-interest bank accounts.The U.S. Government Just Made a Huge Bet

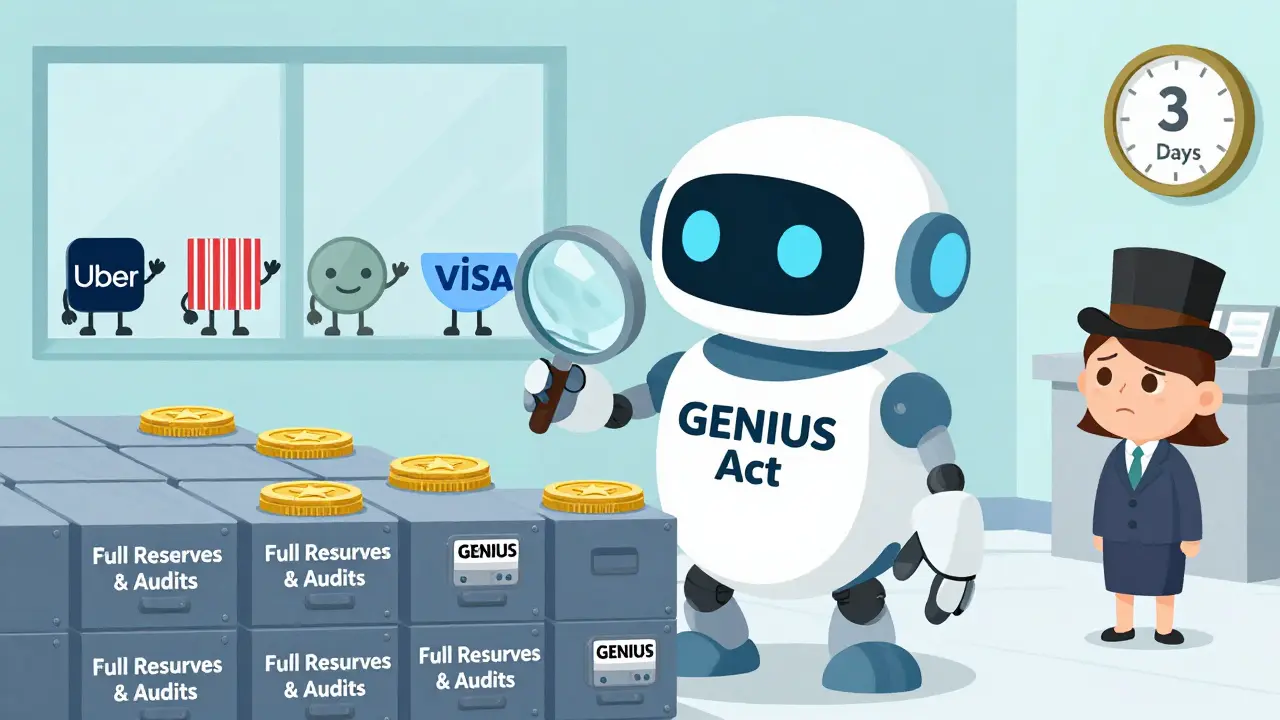

In July 2025, the U.S. passed the GENIUS Act-the first comprehensive federal law regulating payment stablecoins. It didn’t ban them. It didn’t ignore them. It legalized them. The law says: if you want to issue a stablecoin pegged to the dollar, you need a federal charter, full reserve backing, and regular audits. No more shady issuers with unverified reserves. No more Terra-style collapses. The goal? To make U.S. dollar stablecoins the default settlement layer for global blockchain finance. This is a strategic move. The U.S. isn’t trying to build a central bank digital currency (CBDC). It’s betting that private stablecoins, tightly regulated, will extend the dollar’s global dominance. That’s why 99% of all stablecoin value today is tied to the U.S. dollar. But here’s the twist: other countries aren’t sitting still.

The Global Pushback: Non-USD Stablecoins and CBDCs Are Rising

The U.S. wants stablecoins to mean USD stablecoins. But other nations see this as a threat. China has been testing its digital yuan for years. The EU is pushing for a digital euro. Brazil, India, and South Africa are accelerating their own CBDC pilots. And now, countries like Nigeria and Saudi Arabia are launching their own stablecoins-pegged to their local currencies or gold. Why? Because if everyone uses USD stablecoins, they lose control over their own money supply. Imagine if a country’s entire population started holding savings in USDC instead of pesos or rupees. That’s digital dollarization. It weakens their central bank’s power to control inflation, interest rates, and capital flows. The IMF calls this the “Money Revolution.” And it’s not just about technology-it’s about sovereignty. Countries that can’t compete with the U.S. dollar’s reach are racing to build alternatives. The result? We’re not heading toward one global stablecoin. We’re heading toward a multi-currency stablecoin ecosystem.The Catch: Adoption Still Needs a Push

Stablecoins can move $30 billion a day. Sounds big? It’s less than 1% of global payments. The real challenge isn’t tech-it’s behavior. Most people still convert stablecoins back to dollars or euros within hours. They use them as bridges, not homes. To reach $2 trillion by 2028, people need to start keeping money in stablecoins long-term. That means:- Easy on-ramps and off-ramps (no more clunky crypto exchanges)

- Stablecoin debit cards that work everywhere

- Apps that let you pay rent, buy groceries, or split a bill in USDC without thinking

- Businesses that accept stablecoins as standard payment, not just crypto novelty

Risks You Can’t Ignore

This isn’t risk-free. The biggest fear? A cascade failure. If a major stablecoin issuer loses its reserves-whether through fraud, mismanagement, or a bank run-it could trigger panic across global markets. That’s why the GENIUS Act demands full reserve backing and audits. But regulation can’t stop everything. Wholesale markets still prefer central bank money. Banks settle trillions in securities and interbank loans using central bank reserves because they’re risk-free. Stablecoins, even regulated ones, carry counterparty risk. If the issuer goes under, you’re not guaranteed your money. There’s also the issue of privacy. Stablecoins are transparent on the blockchain. Governments can track every transaction. That’s great for stopping crime. But it also means financial surveillance on a scale never seen before.What This All Means for You

If you’re a regular person: stablecoins might soon be how you pay your bills, get paid, or save money-if you live in a country with unstable currency or high fees. You won’t need to understand blockchain. You’ll just use an app. If you’re a business owner: stablecoins can slash your international payment costs by 80%. You can pay suppliers instantly, reduce cash flow delays, and avoid currency losses. If you’re a policymaker: the game has changed. The dollar’s dominance isn’t guaranteed anymore. It’s being defended by code, regulation, and corporate adoption. The future of money isn’t about replacing cash. It’s about replacing the system that moves it. Stablecoins are that replacement. They’re faster, cheaper, and more accessible than anything we’ve had before. And they’re not coming in 10 years-they’re here, right now, quietly rewriting the rules.What’s Next?

By 2027, expect to see:- Major retailers accepting USDC as a payment option

- Mobile wallets with built-in stablecoin accounts

- Central banks launching their own stablecoins alongside CBDCs

- Wall Street firms using stablecoins to settle trades 24/7

Liza Tait-Bailey

January 14 2026ok but like... why does everyone act like stablecoins are magic? they’re just digital dollars with extra steps. i get the speed thing, but if my bank takes 3 days to send money to my cousin in Nigeria, maybe the problem isn’t the system-it’s that we’re still using 1970s tech to move money in 2025. also, who’s auditing these issuers? i’m not trusting some anonymous crypto team with my rent money. 🤷♀️