There is no such thing as FCoinJP - not as a working exchange, not as a licensed platform, and not as a legitimate service you can use in 2026. If you’re searching for reviews, sign-up guides, or fee comparisons for FCoinJP, you’re chasing a ghost. The name might sound real - it even has that fake-Japanese suffix that scammers love - but it doesn’t exist in the real world of regulated crypto trading.

What FCoinJP Actually Is

FCoinJP isn’t a new exchange. It’s a mix-up. The name pulls from two separate things: FCoin, a failed Chinese crypto exchange that shut down in 2019, and Japan, a country with some of the strictest crypto rules on Earth. FCoin was once ranked as the third-largest exchange globally in mid-2018, hitting $10 billion in daily volume. But by September 2019, it stopped all withdrawals. Users lost an estimated $250 million. Chainalysis later listed FCoin among exchanges that “completely ceased operations.”

Japan, on the other hand, doesn’t allow unlicensed exchanges to operate. The Financial Services Agency (FSA) keeps a public list of 23 approved crypto platforms as of January 2026. Names like Bitflyer, Coincheck, GMO Coin, and DMM Bitcoin are on it. None of them are FCoinJP. Not even close. No company has ever applied for a license under that name. No Japanese bank has ever processed deposits for it. No regulatory filing exists.

Why People Think FCoinJP Is Real

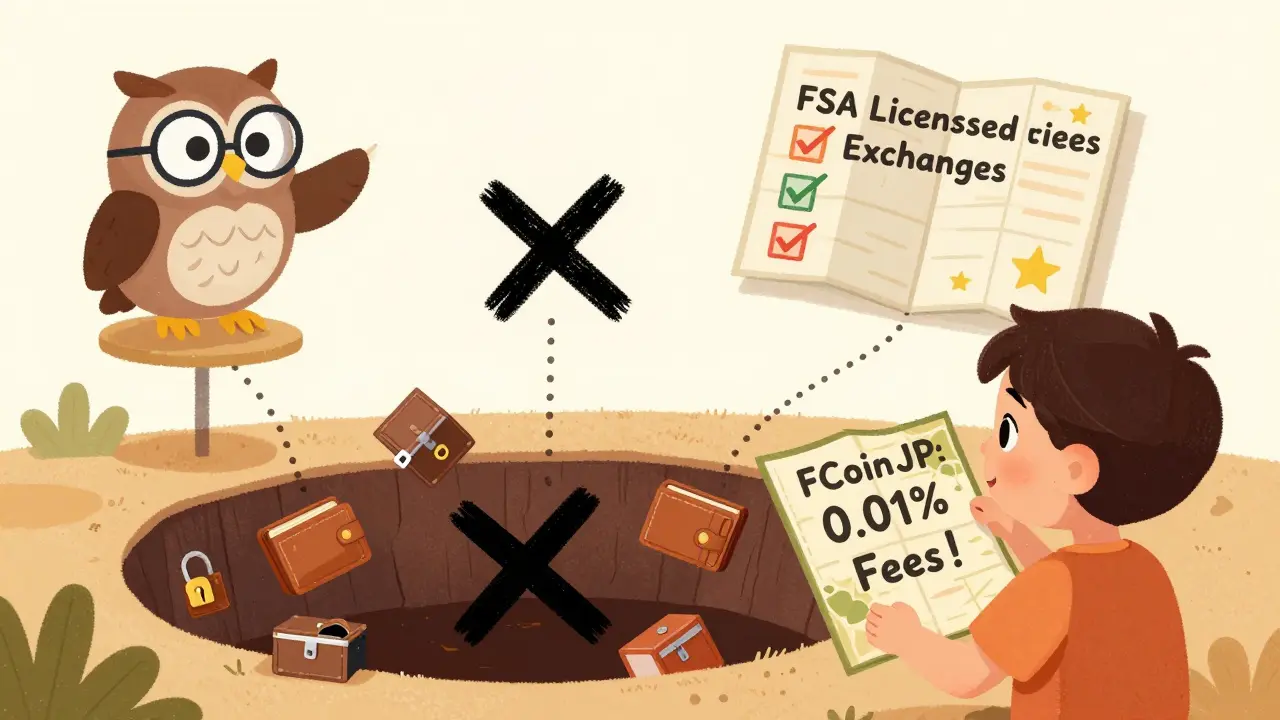

Scammers are good at making things look official. They copy logos from real exchanges, use fake testimonials, and slap “JP” on everything to imply local trust. Some websites even claim FCoinJP offers “0.05% trading fees” or “instant JPY deposits” - claims that sound too good to be true because they are. Real Japanese exchanges like Bitflyer charge 0.1% on JPY trades and require full KYC. FCoinJP offers none of that - because it’s not real.

Search engines sometimes surface these fake sites because they’re optimized for keywords like “FCoinJP review” or “FCoinJP login.” If you click, you might land on a page asking for your wallet seed phrase or pushing a “deposit now” button that leads to a phishing site. There’s no customer support. No email replies. No physical address. Just a blank form and a countdown timer that says “Limited time offer.”

How Japan’s Crypto Exchange Market Really Works

If you want to trade crypto in Japan, you have to use one of the 23 FSA-licensed exchanges. These platforms must meet strict standards: 95% of user funds must be in cold storage, all transactions over 1 million JPY require real-name verification, and they must publish quarterly audits of their reserves. The FSA also bans leveraged trading for retail users and requires two-factor authentication on every account.

Bitflyer, Japan’s largest exchange, has 4.2 million users as of late 2025. It supports JPY deposits at 0.1% fees and offers BTC/JPY and ETH/JPY pairs - which make up 86% of all trading volume in the country. Coincheck, owned by Monex Group, has a strong mobile app but charges higher trading fees between 0.15% and 0.30%. GMO Coin offers low fees for high-volume traders but has a clunky interface. None of them have anything to do with FCoin.

FCoinJP can’t exist under these rules. It would need to register as a Japanese company, pay a 2.5 million JPY ($16,500) annual licensing fee, and submit to monthly audits. No shady offshore operator would do that. If it were real, it would be on the FSA’s website. It’s not.

What Happens If You Try to Use FCoinJP

If you deposit money into FCoinJP, you’re sending it into a black hole. There’s no company behind it. No legal entity. No recourse. Once the funds are gone, they’re gone forever. Unlike regulated exchanges, FCoinJP doesn’t have insurance, doesn’t have a legal team, and doesn’t have a bank account you can sue.

Some users report being asked to pay “withdrawal verification fees” of $500 or more before they can access their own money. That’s a classic scam tactic. Real exchanges never ask you to pay to get your own crypto back. If you’re told you need to pay a fee to unlock your balance, close the page. Walk away. Don’t reply. Don’t send anything.

Even if you don’t deposit, just visiting these sites can be dangerous. Many use malicious scripts that steal browser cookies, log keystrokes, or redirect you to fake login pages for Coinbase or Bitflyer. Your private keys could be stolen without you ever typing a password.

How to Spot a Fake Crypto Exchange

Here’s how to tell if a crypto exchange is real or fake - no matter what name it uses:

- Check the regulator’s official list. For Japan, go to the FSA’s website and search for licensed exchanges. If it’s not there, it’s not legal.

- Look for a physical address. Real exchanges list their registered office. FCoinJP has none.

- Check for user reviews on Trustpilot or Reddit. Bitflyer has over 1,850 reviews. FCoinJP has zero - because real people don’t use it.

- Test customer support. Send an email asking a simple question. Real exchanges reply within 24 hours. Fake ones never respond.

- Watch for too-good-to-be-true fees. “0.01% trading fees”? “Free withdrawals”? That’s bait. Even Binance charges 0.1%.

What to Do Instead of Using FCoinJP

If you’re in Japan and want to trade crypto safely, stick to the FSA-approved list:

- Bitflyer - Best for beginners, low JPY fees, reliable app

- Coincheck - Best mobile experience, good for small trades

- GMO Coin - Best for high-volume traders, low fees at scale

- DMM Bitcoin - Offers futures and margin trading (for experienced users)

All of them support JPY deposits via bank transfer, have clear fee structures, and are legally required to protect your assets. None of them will ever ask you to send crypto to a “verification wallet.”

If you’re outside Japan and looking for a global exchange, use Coinbase, Kraken, or Bybit. They’re regulated in multiple countries, have transparent fee schedules, and offer real customer support. Don’t risk your money on a name that doesn’t exist.

Why This Matters

Crypto scams cost users over $4 billion in 2025 alone, according to Chainalysis. Fake exchanges like FCoinJP are one of the fastest-growing threats. They don’t need hackers. They just need people to believe they’re real. And the more people search for “FCoinJP review,” the more these scams thrive.

Don’t be the next victim. If you see a platform with no regulatory license, no public team, and no verifiable history - walk away. There are plenty of real exchanges that will treat you fairly. You don’t need to gamble on a ghost.

Is FCoinJP a real crypto exchange?

No, FCoinJP is not a real exchange. It does not exist as a licensed or operational platform in Japan or anywhere else. The name is a combination of the defunct Chinese exchange FCoin and the Japanese market, used to trick users into thinking it’s legitimate. Japan’s Financial Services Agency (FSA) has no record of any exchange under this name.

Why do people search for FCoinJP?

People search for FCoinJP because scam websites use SEO tactics to appear in search results for terms like “FCoinJP review” or “FCoinJP login.” These sites copy logos and design elements from real exchanges to look trustworthy. Many users are confused by the “JP” suffix, thinking it means the platform is Japanese and therefore safe - but that’s exactly what the scammers want you to believe.

Can I trust any exchange with “JP” in the name?

Only if it’s on Japan’s official FSA licensed exchange list. Names like BitflyerJP, CoincheckJP, or GMOCoinJP are not official - the real exchanges don’t use “JP” in their branding. The only way to verify legitimacy is to check the FSA’s public registry. Any exchange adding “JP” to a foreign name is likely trying to mislead you.

What happened to the original FCoin exchange?

FCoin was a Chinese crypto exchange launched in 2018 that briefly became the third-largest in the world by trading volume. It collapsed in September 2019 after halting all withdrawals. The company disappeared, and users lost an estimated $250 million. Chainalysis confirmed FCoin as one of the exchanges that “completely ceased operations.” It has no connection to Japan or any current platform.

Which crypto exchanges are safe to use in Japan?

As of January 2026, Japan has 23 FSA-licensed exchanges. The most trusted include Bitflyer, Coincheck, GMO Coin, and DMM Bitcoin. These platforms comply with strict rules: cold storage of 95%+ assets, real-name verification, public audits, and JPY deposit support. Always verify an exchange’s license on the FSA website before depositing any funds.

tim ang

January 22 2026man i just got scammed by this fcointjp thing last week 😭 thought it was legit 'cause the site looked so professional. lost $800 before i realized no one was replying to my support tickets. dont be me.