AMIFS Hub 2024/12 Crypto Archives: Airdrops, Markets, and Fundamentals

When you look at AMIFS Hub, a crypto platform focused on airdrops, markets, insights, fundamentals, and swaps. Also known as the go-to tracker for Web3 opportunities, it gives you real, actionable data—not hype. December 2024 was no exception. This was the month when airdrops started shifting from random airdrop farms to projects with real tokenomics, and exchanges began rolling out new fee structures that actually helped small traders. If you were keeping an eye on your portfolio, you saw it: the market wasn’t just bouncing around. It was building.

Airdrops, free token distributions tied to specific wallet actions or community participation. Also known as crypto rewards for early adopters, it became more selective in December. Projects stopped handing out tokens to anyone who signed up. Instead, they rewarded users who held specific NFTs, used their dApps for at least 30 days, or participated in governance votes. That’s why the airdrops listed here aren’t just links—they’re filtered by eligibility, timing, and past payout history. You won’t find a single fake or dead drop in this archive. Crypto markets, the real-time price movements and trading volumes across major and emerging chains. Also known as the pulse of DeFi, they showed clear patterns in December. Ethereum L2s like Arbitrum and Base led in volume, while Solana had a quiet but steady rise in stablecoin activity. Meanwhile, new memecoins faded fast unless they had real utility behind them. The data here isn’t just charts—it’s what traders actually saw when they logged in each morning. And if you were managing your holdings, you needed coin fundamentals, the underlying project health metrics like token supply, team activity, and on-chain usage. Also known as the truth behind the price, it’s what separated the winners from the noise. December’s posts dug into wallet distribution graphs, GitHub commit logs, and liquidity pool changes—not just price charts.

What You’ll Find in This Archive

You’ll see how crypto swaps became smarter in December. Not just simple token exchanges, but multi-chain, low-slippage trades with integrated gas optimization. The guides here show you how to swap ETH to SOL without paying $50 in fees, or how to claim a new airdrop token and immediately route it to a staking pool—all in one flow. There’s no fluff. No "just hold and wait" advice. Just step-by-step methods that worked for real users.

This archive isn’t a history lesson. It’s a toolkit. Every post here was written for someone who needed to make a decision—whether to claim, swap, hold, or move on. No theory. No guesswork. Just what happened, what worked, and what to watch next.

PancakeSwap v4 LBAMM (BSC) Crypto Exchange Review: Is It Worth It for Meme Coins?

PancakeSwap v4 LBAMM on BSC slashes gas fees by 99% and boosts capital efficiency for meme coin traders. Learn how it works, who it's for, and why it's changing decentralized trading.

What is Onyx Arches (OXA) Crypto Coin? Real Facts About the Travel Payment Token

Onyx Arches (OXA) is a travel-focused crypto token with a $3.1 million market cap and no real-world use. As of November 2025, it's not accepted by any travel companies, has no verified team, and extremely low trading volume.

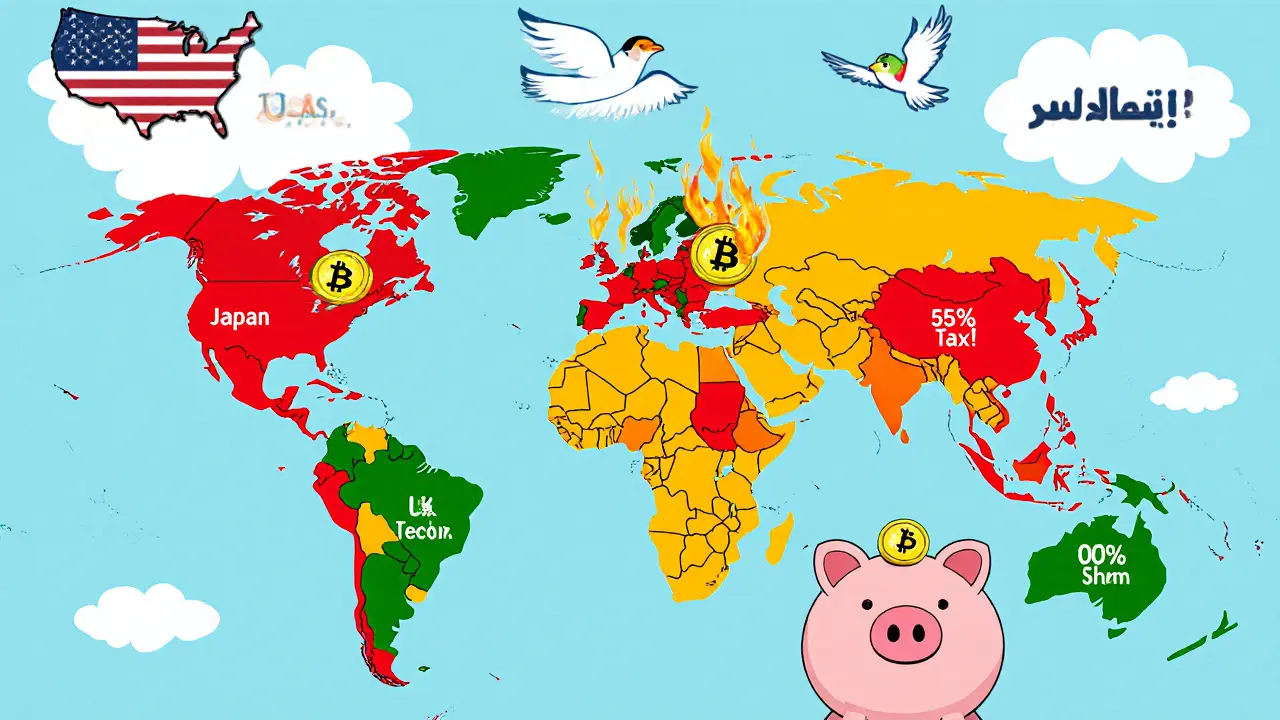

Crypto Tax Rates by Country: Where You Pay the Most and Least in 2025

Discover 2025's crypto tax rates by country-from Japan's 55% tax to the UAE's 0% policy. Learn where you pay the most, where you pay nothing, and how to legally minimize your crypto tax bill.

Best Utility Tokens for Investment in 2025: Real-World Use Cases That Actually Deliver Value

Discover the best utility tokens for investment in 2025 - tokens with real-world use cases like DeFi lending, AI computing, and real estate tokenization. Learn what makes them valuable and how to avoid the 78% that fail.

Loop Finance Crypto Exchange Review: What You Need to Know in 2025

Loop Finance isn't a crypto exchange-it's a speculative token with no platform, no team, and no real utility. Avoid it and stick to trusted exchanges like Binance or Coinbase instead.

Value DeFi Protocol Crypto Exchange Review: What We Know in 2025

Value DeFi Protocol is not a real crypto exchange in 2025. No verified TVL, audits, or team exist. Learn how to spot fake DeFi projects and stick to trusted platforms like Uniswap and AAVE instead.